How To Plan For Retirement When The Value Of Your Money Could Be Halved In 20 Years?

Contributed by

Shiyun Lim

May 26, 2016

Contributed by

Shiyun Lim

May 26, 2016

This is not an alarmist statement. Ask any professional working regularly with numbers, such as accountants, economists, statisticians, and even bankers, and invariably they will tell you something like this …

Factually, the money in your savings account gets 0.05% and the long-term annual inflation rate, however you measure it, trends between 2% and 4%. Therefore, mathematically, the actual purchasing value of your bank savings (plus compounded interest) will shrink year by year.

Let’s start with a $100,000 deposit in the bank (2016).

Although the bank statement shows your balance has “grown” to $100,050, the purchasing power of that money after one year is $97,050 (assuming 3% inflation rate). As a consumer, you will surely notice that – with some exceptions such as IT products – goods and services just get more expensive as the years pass by. These even include government services, such as passport renewal fees, traffic fines, hospital charges and school fees. Let the numbers speak for themselves. In 20 years’ time (2036), your bank savings account will show $101,004, however, the equivalent purchasing value (as compared to 2016) is less than $55,000.

Let’s be smarter and roll the $100,000 in annual fixed deposits (say averaging at 1.6% per year). Since this is still lower than the long-term rate of inflation, it is no surprise that the purchasing value has declined to about $75,000.

The cost of bus fares, drinks, a bowl of noodles, chocolate bars, cinema tickets, and visits to the doctor creeps up every year – everyone has experienced the effects of inflation. In the ’70s you could have a set lunch at Magnolia snack bar for $2-3. In the ’90s you could enjoy a set lunch for $5-6 at Jack’s Place. Today, many eating outlets are struggling to keep the price of set lunches below $10.

Twenty years ago, $10 was a big deal and stallholders would scold you if you tried to use a $50 note. Today, they accept your $100 note without hesitation. Even ATMs do not dispense $10 notes anymore.

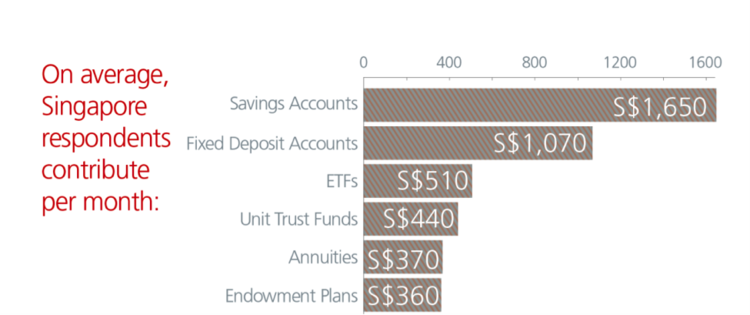

But despite the fact that our money will erode in the bank, cash remains a big part of Singaporeans’ wealth portfolio. According to the DBS Retirement Planning report in 2014, Singaporeans surveyed reported that cash savings (73%), CPF savings (72%), and insurance/investment/annuity plans (64%) are their key sources of retirement income. And each month they continue to put more than 60% of their savings into their bank accounts as opposed to other forms of investments, as illustrated in the chart below. This is tragic, as we do not recommend keeping more than six to 12 months of salary as emergency funds in the bank.

If you plan to retire in 20 years’ time, leaving your savings in the bank will get you nowhere, as the inflation-adjusted needs will be double, as shown earlier on. This means, using today’s cost of living as a benchmark, if you would like to enjoy a personal pension of $36,000 a year, you will need to withdraw $65,020 in cash in the first year. Here are three scenarios to consider.

Scenario 1 (Very Conservative Saver)

You are very worried and believe the safest option is to keep all your savings liquid in the bank. Given today’s growing life expectancy, you will need to target a retirement sum of $1.7million. It’s going to take you a long time to save this sum, especially if you do not believe in investments and depend on fixed deposits to grow your wealth. This is, frankly, not a very smart strategy for most people who do not have inherited wealth.

Scenario 2 (Low-Risk Saver)

You are someone who prefers lower-risk instruments, such as fixed income, endowment plans, insurance plans and annuity plans. Capital values will fluctuate less. Expect to see your investments yield about 3% annually on average. We project that you would need a retirement sum of $1.3 million, as your moderate yielding portfolio will help you withstand the ravages of inflation.

Scenario 3 (High-Risk Saver)

Someone who is young or quite financially savvy can afford to take more investment risks due to their longer time horizon of accumulation and/or appreciation of the dynamics of investment. Stocks and unit trusts that invest in equities and commodities are viable options for consideration. A targeted retirement sum of $1 million will then be required by putting savings into instruments that aim to yield at least 6% during the accumulation phase, continuing into the early years of the drawdown period.

In Singapore, we are fortunate to have the CPF with a range of schemes that offer higher interest rates than the banks. So any proper retirement plan should take into account the unique features of the CPF schemes, such as its virtually iron-clad capital guaranteed nature. Currently OA interest rate is 2.5% and up to 3.5% for the first $20,000. SA is 4% – 5% for the first $40,000. It would then make sense to make transfers to SA to enjoy the higher interest rate and hedge against inflation if you no longer need to buy or upgrade your home, since this is irreversible. Also, there is a CPF Annual Contribution Limit.

Having your money lose half of its value is no trivial matter. Be proactive. Speak to a financial advisor on how you can start setting aside part of your monthly income for your retirement goals.

Visit Cents & Sensibility page to find out more about Shiyun’s work.

Sorry, the comment form is closed at this time.